Limit Control For Fund Of Funds

The Limit Control component was designed by seasoned hedge FoF managers and assimilates the best industry practices for portfolio management of fund of funds and hedge fund of funds. By offering a sophisticated yet user-friendly framework for managing various user-defined limits on hedge fund portfolios, it greatly facilitates routine portfolio management and help you maintain more risk-efficient portfolios.

Enhanced Portfolio Management

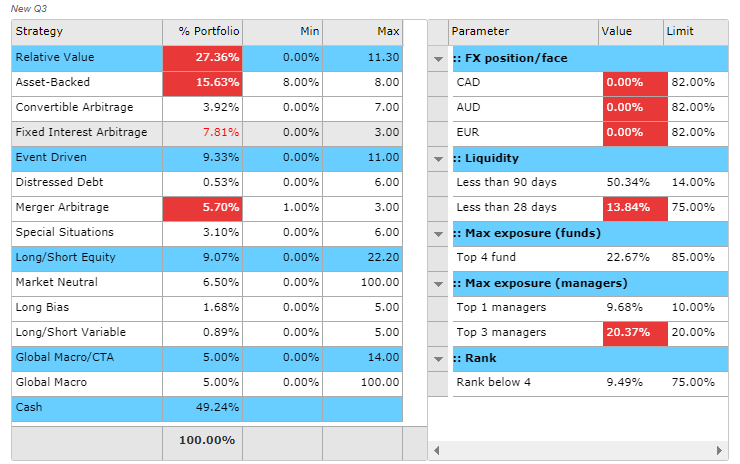

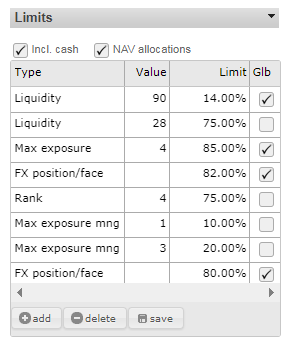

- Create your own risk limits

- Monitor portfolio risk limits in real time

- Easily identify limit breaches

- Comply with the relevant legal and regulatory requirements

Monitor Portfolio Limits in Real-Time

- Unlimited number of risk limits

- Various limit types: liquidity, exposure, FX position/face, manager ranking and so on

- Tracking historical portfolio limit data

- Single portfolio or aggregated multi-portfolio limits