Fund Accounting Software

The Risk Shell Fund of Funds (FoF) Manager is a portfolio management and accounting framework developed specifically for family offices and alternative investments. Boasting advanced shadow accounting features, in-depth portfolio liquidity and exposure analysis, comprehensive cash-flow assessment, and efficient multi-currency cash management, the FoF Manager lays a solid groundwork to meet the discerning requirements of alternative managers.

Tailored For Hedge Fund of Funds

The distinct features of FoF Manager, designed to combine complex investment fund accounting software with the nuances of hedge funds, are highlighted below.

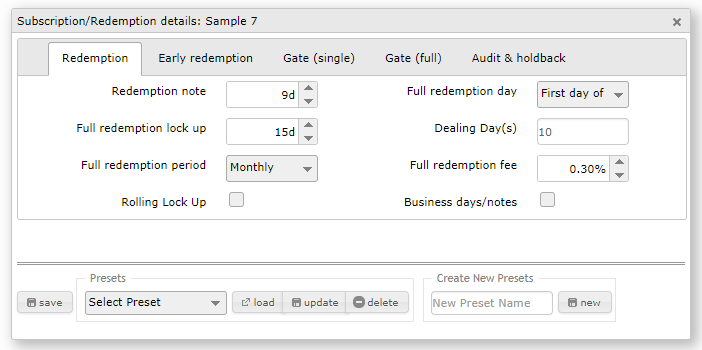

- Liquidity Analysis tools for managing complex hedge fund redemption scenarios.

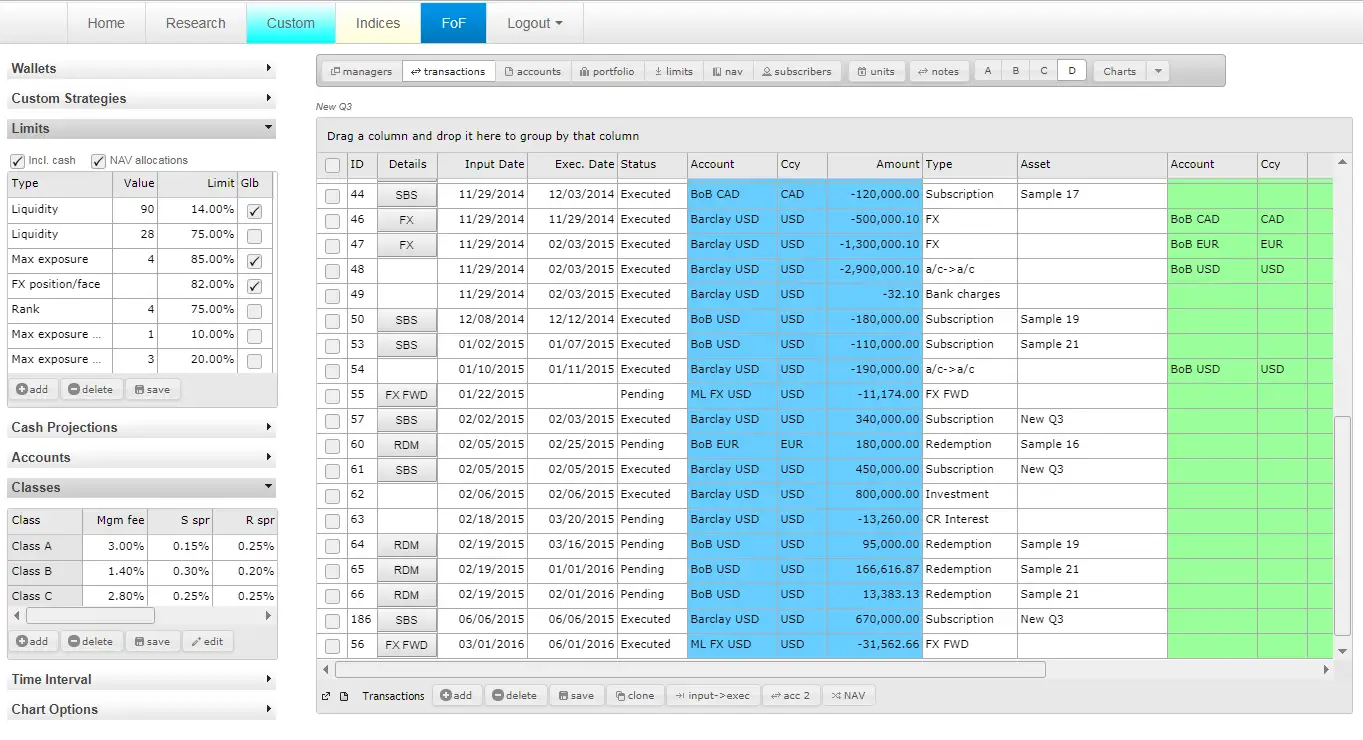

- Shadow Accounting SaaS platform featuring: Portfolio Blotter, Cash flow projection and Transaction Manager components.

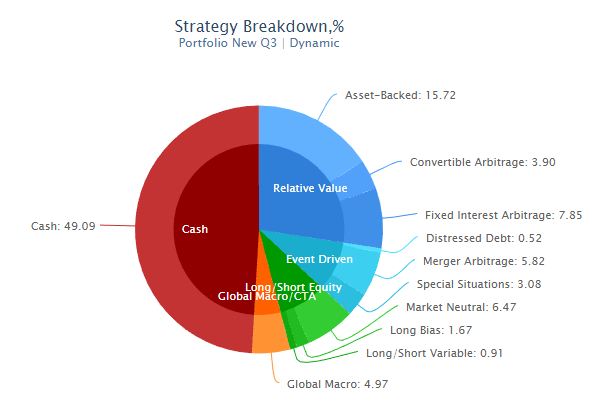

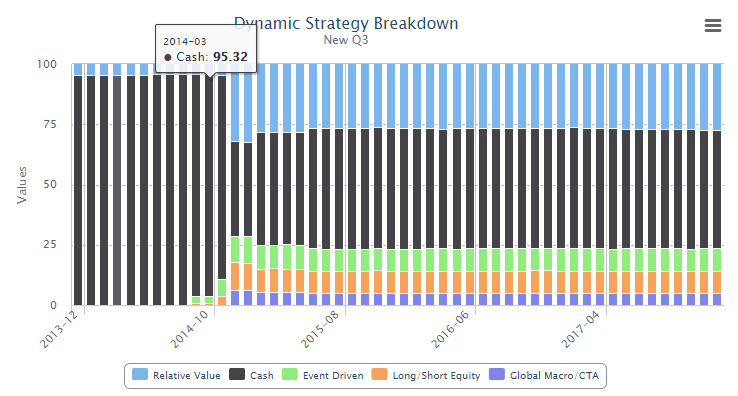

- Portfolio Exposure Analysis tools providing real-time or historical insights into portfolio strategy or geographical exposure.

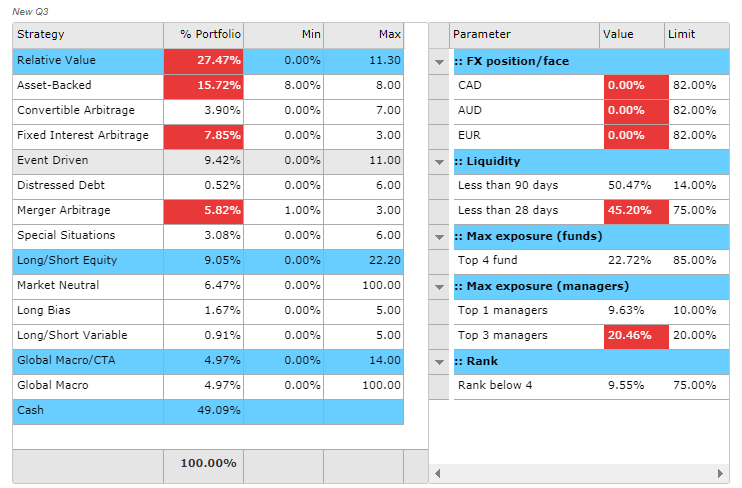

- Portfolio Limit Control module monitoring pre-set portfolio risk limits in real time.

- Custom Strategy Classification system.

- Class Manager supporting multi-currency and multiple fund classes.

- Single fund portfolios or combined positions across multiple funds.

- Support for Master-Feeder funds.

- Dynamic, Closed Period, and Incremental modes.

- Portfolio audit tools integrated with Transaction Manager.

- Reports can be run as-off and/or as-on any date.

- Fully integrated with the Risk Shell analytics and portfolio construction tools.

Portfolio Management And Accounting Solution For Family Offices

As the FoF Manager was developed to manage a diverse range of fund of funds and multi-asset portfolios, it proves to be an ideal tool for family offices. Nonetheless, family offices entail additional requirements beyond traditional investment fund accounting, requiring specific FoF Manager features as outlined below.

- Multi-master - Multi-feeder support to handle complex holding portfolio structures.

- An all-in-one platform seamlessly integrating fund accounting software, portfolio and fund management, and reporting functionalities.

- Special transactions specific to private equity and real estate investments such as Capital Calls or Rents.

- Custom geographic classification for tracking geographical exposure risks.

- Transaction automation to maintain master portfolios' transactions via holding portfolios.

FoF Manager Highlights

-

Book Your Spot: Mastering Portfolio Management

11 Apr 2025;

04:00PM - 05:00PM

Complex redemptions: hedge funds16 Apr 2025;

09:00AM - 10:00AM

Master and Feeder Portfolios16 Apr 2025;

02:30PM - 03:30PM

Fund Of Funds Accounting: Basic Setup25 Apr 2025;

04:00PM - 05:00PM

FoF Manager Introduction02 May 2025;

04:00PM - 05:00PM

Complex redemptions: hedge funds

FAQs

What is Custom Category Classification?

FoF Manager offers a function of creating user-defined manager classification systems. It supports two-level categories (strategy and sub strategy) as well as weighted multi-strategies.Are multi-currency positions supported?

Yes. FoF Manager fully supports multi-currency underlying assets. Portfolios are reconciled daily based on EOD exchange rates.What are supported NAV frequencies?

Any regular period frequencies (daily, weekly, monthly etc.) as well as irregular interval NAV entries are supportedIs FX forward hedging supported?

Yes. You can hedge multi-currency positions by FX forwards.

Are historical portfolio evaluations supported?

FoF Manager supports historical valuation at any given past date as well as incremental valuations between two dates.Can I define multiple gate redemptions?

FoF Manager offers over 30 redemptions terms including early redemptions and up to 3 subsequent redemptions.Can I use historical portfolio NAV in Risk Shell?

FoF Manager is seamlessly integrated with Risk Shell. Actual portfolio historical NAVs can be used across any Risk Shell components for portfolio risk analysis.Can FoF Manager get data directly from our Administrator?

Yes. We offer an option of linking FoF Manager to administrators' data feeds - as a custom development on-demand.