Peer Group Analysis For Hedge Funds And Fund Of Funds

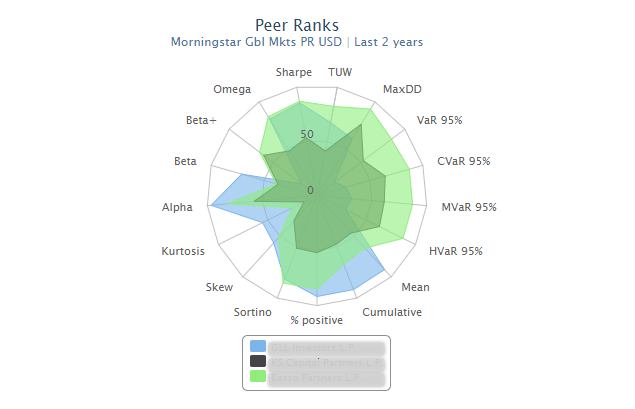

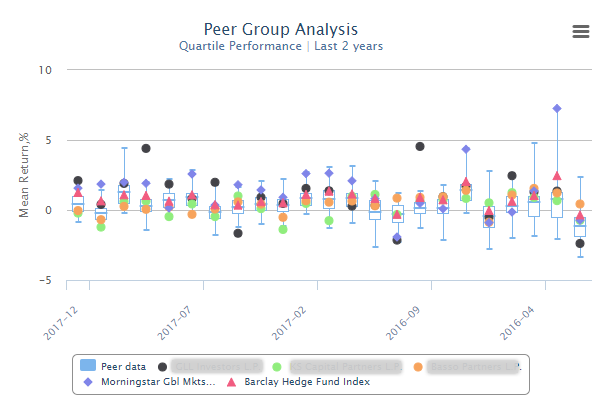

The traditional Peer Group Analysis based on the Box-and-Whisker diagrams has been known for years. Risk Shell offers you a more advanced concept of Multi-statistic Peer Group Analysis, first introduced by ABC Quant in 2005 specifically for hedge fund assessment. In contrast with the box plots, it delivers a deeper insight into manager risk profiles by comparing selected assets against their peers across multiple statistics simultaneously.

Benefits For Hedge Fund Investors

- Instantly identify strong a week points of any assets across multiple risk metrics

- Find the best performers in a group with the best overall risk profiles

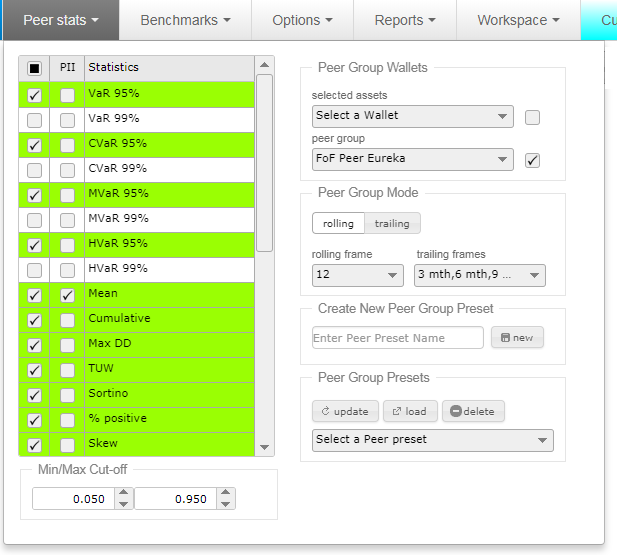

- Key metrics of Peer Group Analysis at your fingertips in real-time: VaRs, Sortino, Drawdowns, Omega, Alpha, Beta and many more

- Maintain an accurate and holistic view of portfolio constituents

Peer Group Analysis Features

- Traditional box plot and multi-statistic Peer Groups Analysis

- 70+ risk statistics supported

- Stress test data for historical extreme events supported

- Rolling and Trailing modes supported

- User-defined time intervals

- Peer model presets

- Flexible peer group composition

- Multiple vs. multiple asset comparison