Stress Testing For Hedge Funds And Fund Of Funds

Risk Shell Stress Testing component delivers numerous tools to identify and mitigate potential event risks. It is capable of stressing single assets (hedge funds, CTA, traditional long-only funds, equities, fixed income instruments and derivatives) and multi-asset investment portfolios across hundreds of past extreme events as well as user-defined scenarios.

Benefits For Hedge Fund Investors

- Identify potential losses due to event risk

- Mitigate the impact of devastating market conditions

- Build your own stress scenarios

- Predict impacts of extreme event shocks

Advanced Software Features

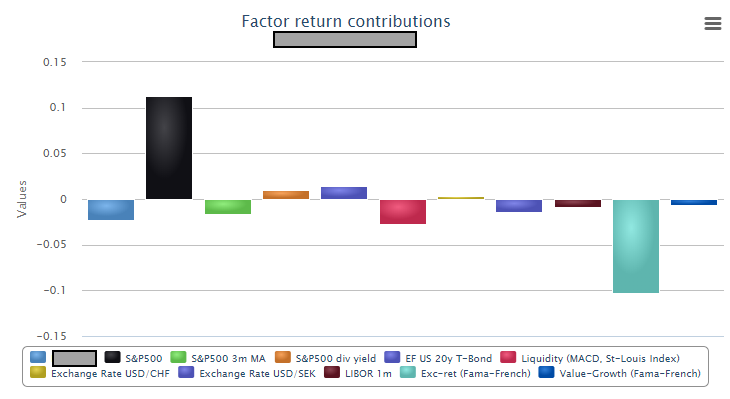

- Stress by Risk Factor, Risk Type or Date

- 50+ extreme event scenarios

- Single or multiple factor stressing

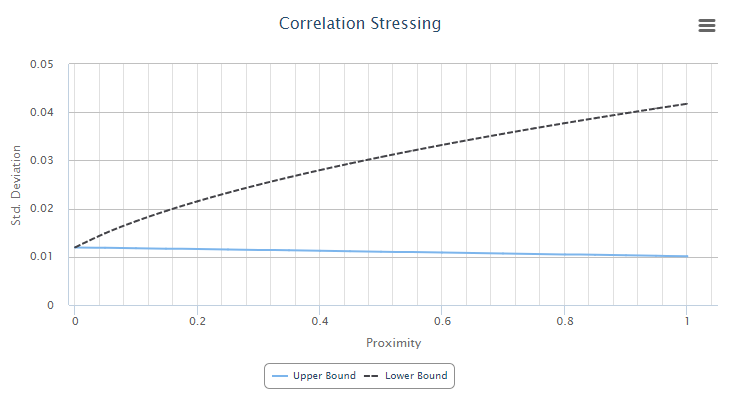

- Correlation stressing

- Returns-Based and Holdings-Based factor models

- Factor predictive stress scenarios

- Unlimited number of market factors for stress testing

- Modeling macroeconomic shocks