Factor Analysis And Style Analysis Software For Hedge Funds And Fund Of Funds

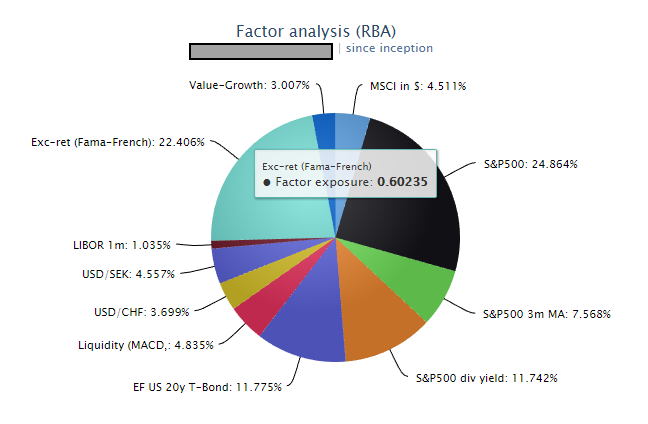

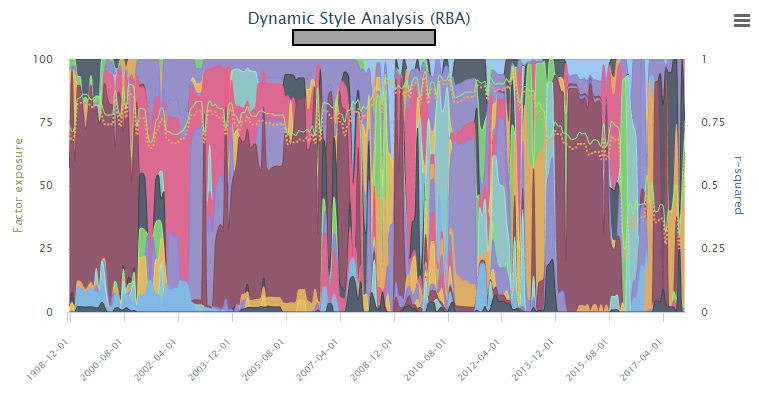

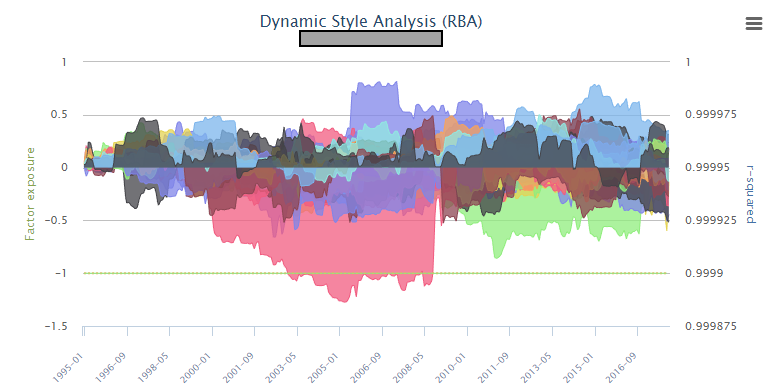

The Factor Analysis component of Risk Shell utilizes various statistical models to reveal the relationship between an independent variable (typically a fund or an asset being analyzed) and a group of explanatory variables or a factor subset (typically macroeconomic factors, global indices or style indices). The output of factor analysis is a regression factor model that explains asset returns in terms of identified factors' returns. That factor model can be further used for the Style Analysis purposes or stress testing. Risk Shell offers both Returns-Based and Holdings-Based factor analysis as well as Static and Dynamic Style Analysis designed specifically for hedge funds and alternative investments.

Benefits For Hedge Fund Investors And Fund of Funds

- Find driving factors of asset performance

- Analyze manager style drift and historical factor exposure changes

- Build a reliable factor model for stress testing

Manager Style Analysis: Key Features

- Static and Dynamic Style Analysis

- Advanced regression models

- Kalman filters

- User-defined factor subsets

- Elastic-net, LASSO and Ridge regression models

- Principal Component Analysis

- Akaike Information Criterion (AIC)