Holdings-Based Analysis Software

To overcome known limitations of Returns-Based Analysis of hedge funds, Risk Shell offers a comprehensive Holdings-Based Analysis across all asset classes including equities, fixed income, commodities, swaps and so on. Our Holdings-Based analysis is not just a breakdown of categories of underlying positions, but a full-scale risk evaluation of holding portfolios including factor analysis, stress testing, VaR estimates and many more.

Benefits For Hedge Fund Investors

- Evaluate risks based on latest holdings data rather than past performance

- Analyze funds with short return series

- Monitor exposure across multiple asset classes

- Maintain an accurate and holistic view of consolidated portfolio underlying assets

- Switch between Holdings- and Returns-Based analysis by a single click

Holdings-Based Analysis Features

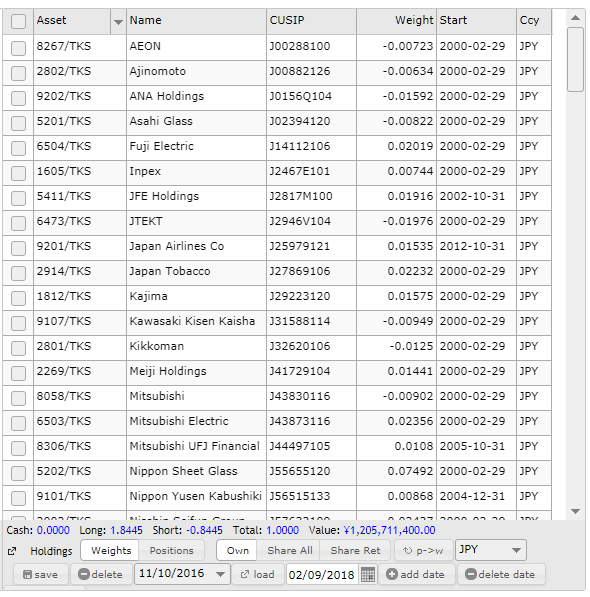

- All asset classes are supported via Risk Shell data sets or the Bloomberg Enterprise Data Feed

- Multiple date holdings snapshots

- Batch holdings uploading

- Cross-currency holdings positions

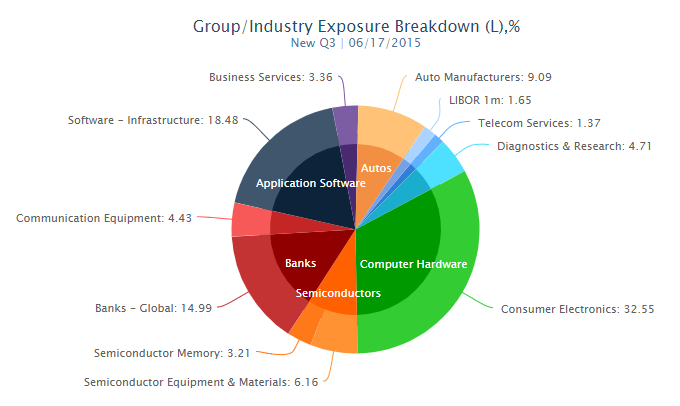

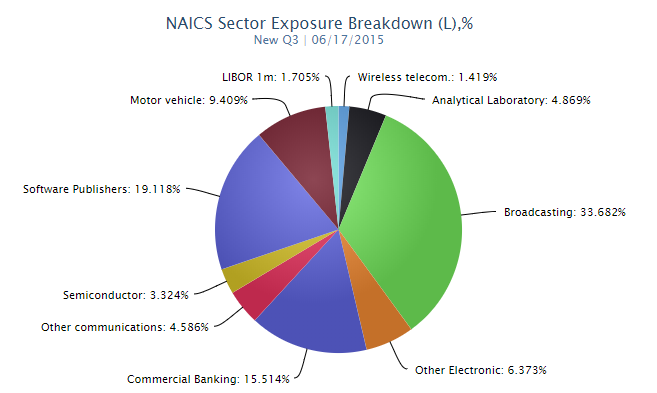

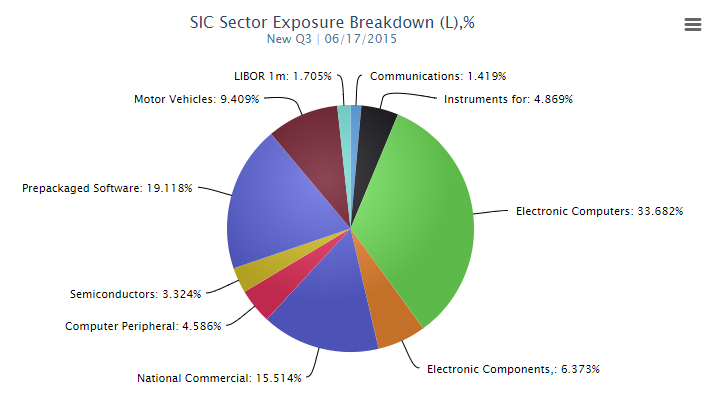

- Multiple asset exposure classification systems: Morningstar®, SIC and NAICS

- Long and short positions