Index And Proxy Builder For Hedge Fund Investors

As a quantitative risk analyst, you know the importance of well-constructed sets of explanatory variables for factor analysis and stress testing. Identifying such variables or factors is not a trivial task, especially when it comes to alternative assets with exposures to complex instruments across various markets. Risk Shell Index Builder makes that task easier by offering advanced tools for a factor (benchmark) selection.

Run Better Style Analysis - Precise Stress Testing

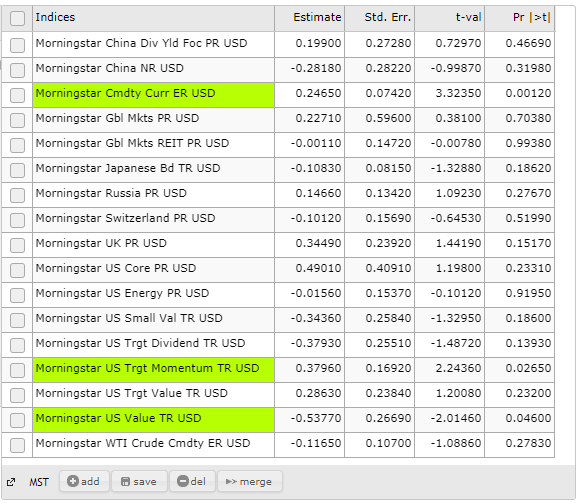

- Instantly identify the best fit factor subset for any given instrument

- Create a custom user-defined index, benchmark or proxy

- Find appropriate indices or benchmarks for any asset classes

- Maintain an accurate and holistic view of factor diversification

Advanced Risk Analytics

- Quantitative index search filters

- Elastic-net, LASSO and Ridge regression

- Akaike Information Criterion (AIC)

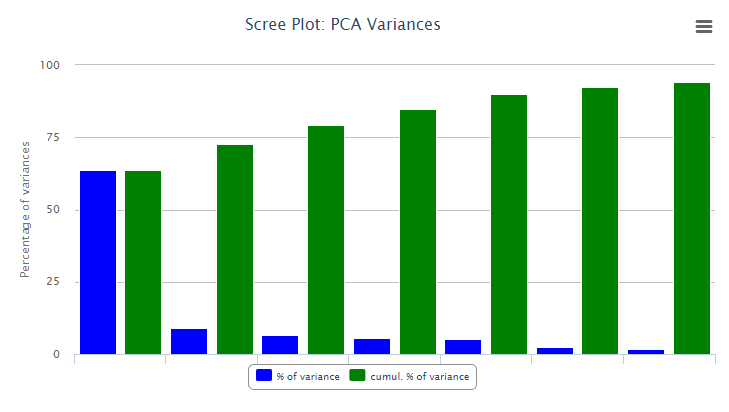

- Principal Component Analysis

- Correlation heat maps

- Unlimited user-defined factor subsets