Portfolio Construction Software For Fund of Funds

The Risk Shell Portfolio Construction component provides sophisticated quantitative tools tailored for the construction of investment portfolios, specifically designed to cater to various categories of investment funds.

Risk Shell Supported Investment Portfolios

- Hedge fund of funds

- Long-only traditional funds

- Multi-asset funds and portfolios

- Multi-manager funds

- Equity long-only and long-short portfolios

- Private equity portfolios

How It Helps Asset Managers And Fund Of Funds Managers

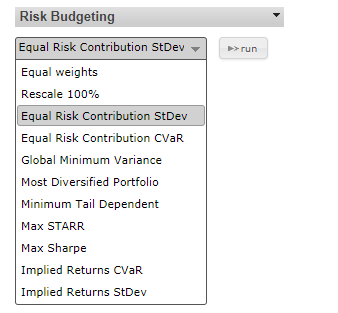

- Enhance portfolio performance using risk budgeting

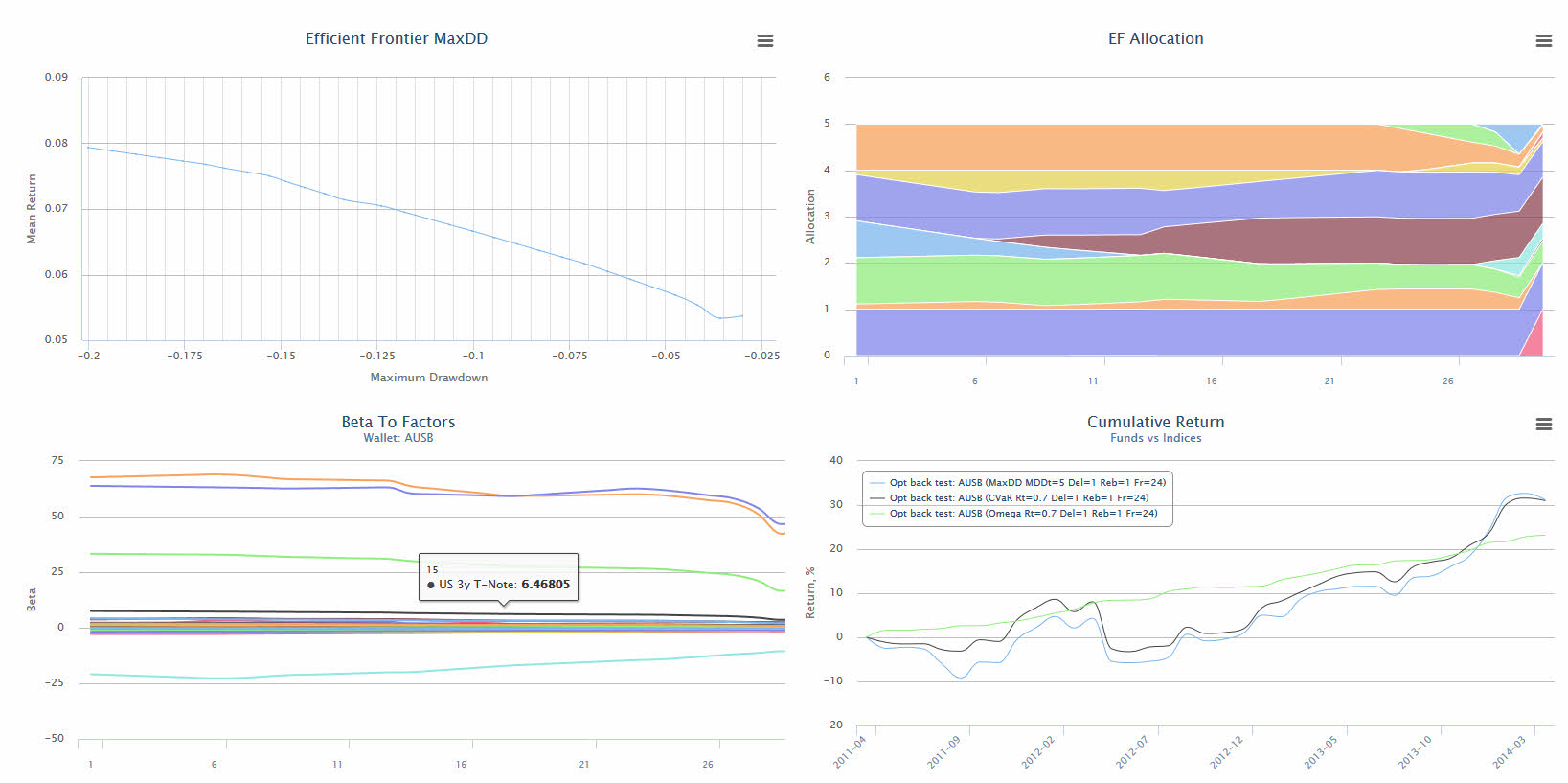

- Optimize portfolios over a broad range of models (CVaR, Omega, Max Drawdown and many more)

- Find optimal asset allocations using a broad range of constraints (stress testing, liquidity, strategy exposure and many more)

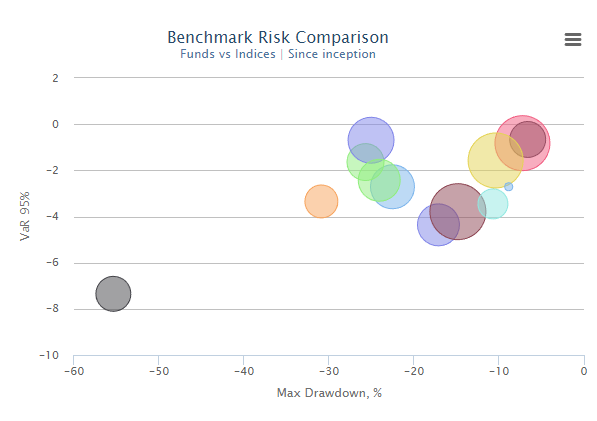

- Reduce risks by improving portfolio diversification

- Backtest asset allocation strategies

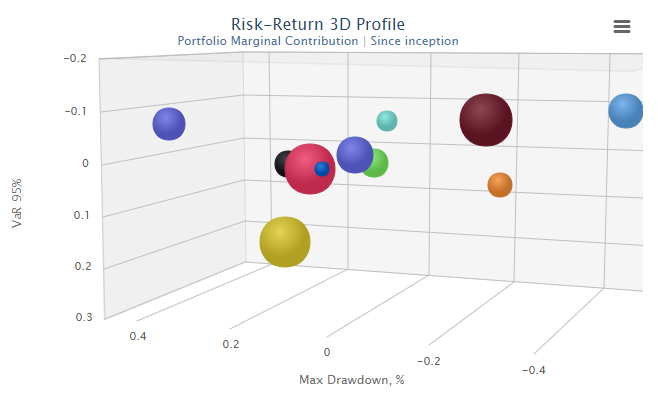

- Analyze marginal risk contributions of underlying assets

- Build market-neutral portfolios

Portfolio Construction Modules

- Risk budgeting (10+ strategies including Equal Risk Contribution, Global Minimum Variance Portfolio, Most Diversified Portfolio, Minimum Tail Dependent Portfolio and many more)

- What-if analysis

- Diversification and correlation analysis

- Marginal risk contribution analysis

- Non-linear and Differential Evolution Optimization

- Market-neutral portfolio builder

- Backtesting: single and batch modes

- Background or real-time portfolio optimization

- Portfolio rebalancing module

- Copula-based multivariate stochastic simulation